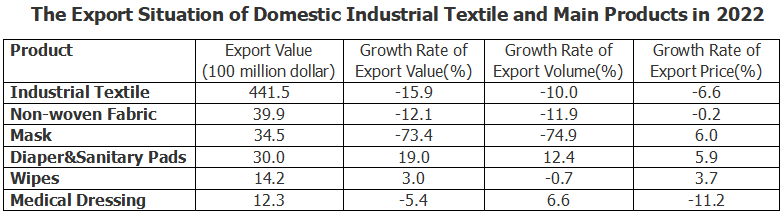

Disposable hygiene product (including absorbent hygiene products and wet wipes) is one of the final product of non-woven fabric. In 2022, the overseas market showed a strong demand for disposable hygiene products, with export value reaching $3 billion, YoY+19%, and the export value to Russia doubled compared to the previous year. The export value of non-woven fabric protective clothing was $1.08 billion, YoY-50.3%. The export value of wet wipes was $670 million, YoY+6.7%. In the first quarter of 2023, the export value of disposable hygiene products was $800 million, YoY+23.2%. The export value of masks and non-woven fabric protective clothing decreased by 73.8% and 32.2% respectively, compared to the same period last year.

In 2021, the development of the domestic disposable hygiene products market slowed down. The total market size of absorbent hygiene products (including female hygiene products, baby diapers, and adult incontinence products) was ¥114.25 billion, YoY-5.9%. The consumption of period pants and adult incontinence products has significantly increased compared to 2020, while the consumption of baby diapers continued to decline since 2020.

Female hygiene products:

Female hygiene products accounted for 54.1%(slightly increased) in absorbent hygiene products market. Among which, the growth rate of period pants products reached 59.2% due to its convenience and leak-proof characteristics. Female hygiene products market penetration rate has reached 100%, and the space for market development is limited. The growth of this industry in the future will be driven by the rising demand for frequent usage from users and the development of high-end products.

Baby diapers:

Baby diapers/pants accounted for 36.1%(continuing to decline) in absorbent hygiene products market. The birth rate of the population was 6.675‰, which was the first negative growth over the past 61 years, leading to severe overcapacity and fierce competition in the domestic diaper market. In 2021, the production volume, factory sales volume and sales revenue of baby diapers in domestic market showed a simultaneous declined for the first time in recent years. Meanwhile, the market penetration rate of baby diapers increased.

Adult incontinence products:

Adult incontinence products accounted for 9.8%(continuing to increase) in absorbent hygiene products market. The consumption of adult incontinence products continued to grow at a double-digit rate in 2021, but the market size slightly decreased.

Wipes:

During the epidemic period, a large amount of investment poured into the wipes market, resulting in fierce competition in this field. However, the demand returned to normal levels in 2021.

The downstream sanitary napkin and diaper industry has a high concentration, with the top 20 manufacturers dominating the market share. Therefore, disposable hygiene product manufacturers need to provide consumers with cost-effective, higher-quality and distinctive products to sustain their competitive edge.